There may be certain jurisdictions in which our ETPs are not available to investors. Please consult your local advisor to determine whether you are permitted to invest.

ABOLD

Adaptivv Bitcoin Gold ETP+

ISIN: CH1453363843

Adaptivv Bitcoin Gold ETP+ (ADBLD) combines Bitcoin’s upside with Gold’s stability, using the Adaptivv Sensor®Sensor Technology from ETH Zurich to dynamically allocate 25-75% in Bitcoins and rest in Gold in a fully collateralized, rule-based product.

YTD Yield:

+0.11%

3 Months:

-6.82%

2025:

+14.39%

per End of January 2026

Performance since inception

-8.63%

Overview

Adaptivv Bitcoin Gold ETP+ (ABOLD) offers disciplined exposure to the only two true monetary reserve assets—Gold and Bitcoin (digital gold)—with dynamic allocation (25–75% Bitcoin) guided by the Adaptivv Stability Sensor® from ETH Zurich, combining Bitcoin’s upside with Gold’s stability in one intelligent, physically backed product.

Documents

Benefits

-

Dual reserve asset strategy

ABOLD combines the only two true monetary reserve assets—Gold and Bitcoin (digital gold)—into a single, intelligent product.

-

Protection against Crypto Winters

Aims to mitigate the emotional and financial strain of Bitcoin's historical drawdowns, which have reached nearly 80%.

-

Adaptive exposure

The product dynamically shifts between 25–75% Bitcoin and Gold, depending on market stability as measured by the Sensor.

-

High Liquidity and Security

ABOLD is tradable daily on the SIX Swiss Exchange and BX Swiss, ensuring high liquidity. The ETP+ is fully collateralized, offering enhanced security to investors.

-

Proven Track Record

The Adaptivv Sensor® Technology has been operational since 2016, showcasing a strong and reliable performance history.

-

Participating in Bitcoin Growth

Bitcoin has been the best performing asset of the last 3 years. Get involved with a risk-control framework.

| Key Information | |

|---|---|

| Asset Class | Bitcoin/Gold |

| Investment Type | ETP+ |

| Currency | USD |

| Use of Income | Accumulating |

| Issue Date | 14.08.2025 |

| Maturity Date | Open-End |

| Listed | SIX Swiss Exchange PLC, Zurich, Switzerland |

| Management Fee (p.a.) | 0.5% including Issuer Fee |

| Performance Fee | 5% |

| Liquidity | Daily |

| Index Sponsor | Adaptivv Financial Technologies Ltd |

| Issuer | Leonteq Securities PLC, Guernsey Branch (collateralized) |

| Collateral Agent | SIX Repo Ltd, Zurich, Switzerland |

| Offering | Public offering only in Switzerland |

| Tickers | |

|---|---|

| Valor | 145336384 |

| ISIN | CH1453363843 |

| SIX Symbol | ABOLD |

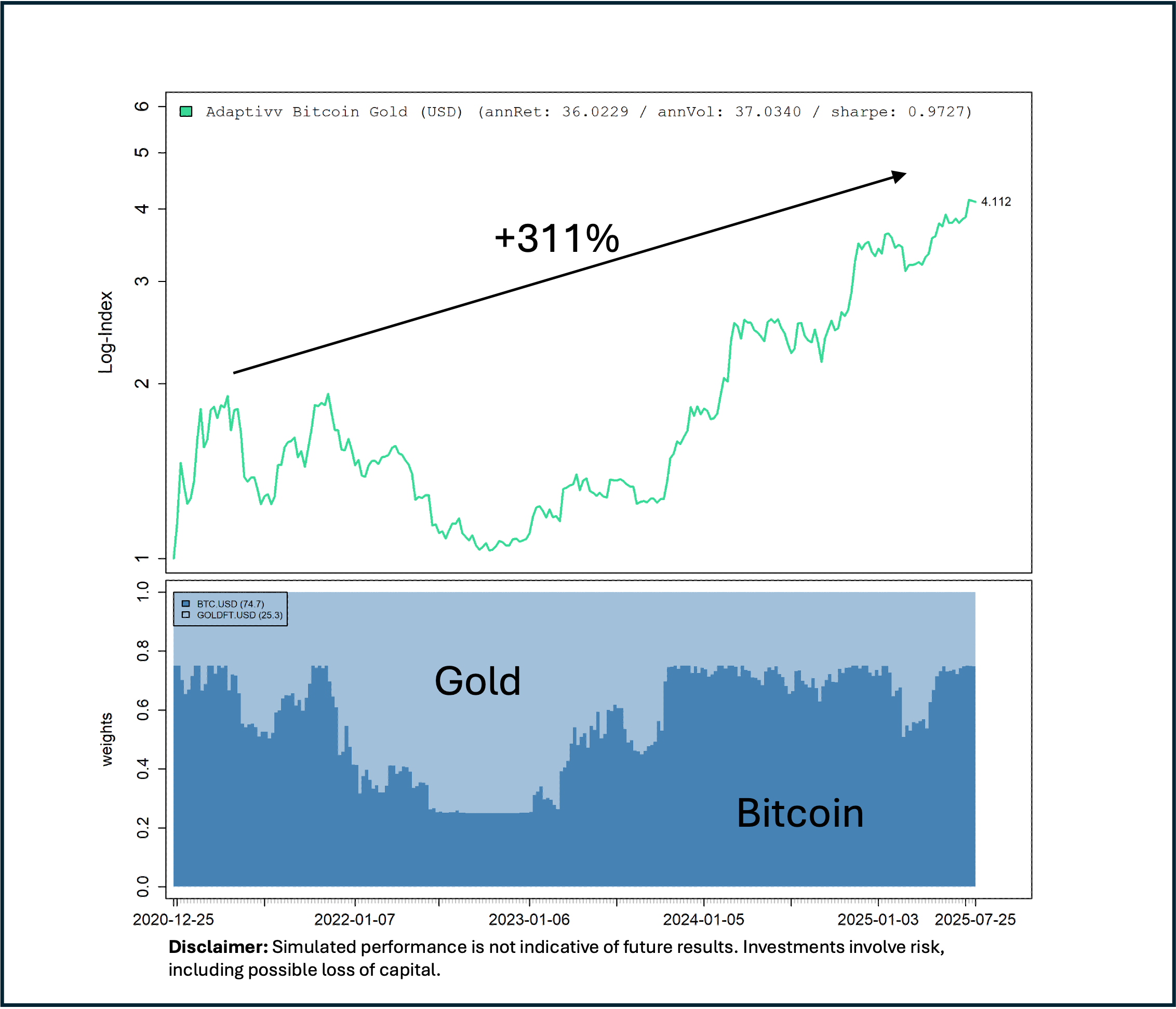

Simulation

Ann. Return:

+36%

Ann. Vol:

+37%

Sharp:

+0.97%

as of 23.02.2024

Dr. Tobias Setz, Partner Adaptivv

"With ABOLD, we bring our scientific approach to two of the most important monetary reserve assets. Our Adaptivv Stability Sensor® allows investors to participate in Bitcoin’s upside while systematically managing risk through dynamic allocation with gold."

How to invest: A step by step guide

①

Search for a specific ETP by using its ticker symbol, ISIN or name on the bank/broker platform

②

Select the number of ETP shares you wish to purchase and specify the order type (market order, limit order, stop loss, etc.)

⓷

Review your order to ensure accuracy and confirm the trade)

⓸

After the ETP order is executed, you can track the investment's performance through your brokerage account

Available Investment Products

| Product | ISIN | Currency | Date | Inception Date | ITD i | MTD i | YTD i | Downloads | Links |

|---|

This document constitutes advertising within the meaning of article 68 of the FinSA and is intended for information only and for personal use.

The financial products in this document do not qualify as units of a collective investment scheme in the meaning of Article 7 et seqq. of the Swiss Federal Act on Collective Investment Schemes (CISA) and are therefore neither supervised by the Swiss Financial Market Supervisory Authority (FINMA) nor registered with FINMA. Investors do not benefit from the specific investor protection provided under CISA.

No action has been or will be taken to permit a public offering of the financial products or possession or distribution of any offering material in relation to the financial products in any jurisdiction, where such action for that purpose is required. The most important jurisdictions where the financial products may not be publicly distributed are EEA, UK, Hong Kong and Singapore. The financial products may not be offered or sold within the USA, or to or for the account or benefit of US persons (as defined in Regulation S).

It does not constitute a public offering, an offer to sell or a solicitation to buy any financial instruments and it is not research. It is not intended to form investment, legal or tax advice and should not be used as the basis for investment decisions. Before making an investment decision, you should obtain professional advice. Past performance is no indicator or guarantee of the future performance of a financial instrument. Individual services and products are subject to legal restrictions in certain countries. They may therefore not be offered throughout the world without restriction. All information is made without warranty to its currency, accuracy, or completeness. Adaptivv reserves the right to alter its services, products, or prices at any time without prior notice. Adaptivv rejects any and all liability for incorrect or incomplete information. No responsibility is assumed in case of unsolicited delivery. Complete or partial reproduction without the express consent of Adaptivv is not permitted.

The relevant product documentation of the financial products can be obtained directly at Adaptivv via telephone: +41 44 552 49 09 or via email: info@adaptivv.com.

© Adaptivv 2024. All rights reserved.