Our Investment Technology is the Foundation of our Adaptivv Sensor.

We use a mathematical model called Bayesian Change Point (BCP) analysis to measure regime changes. This is new to the financial market as the methodology is mainly used in other scientific fields like DNA sequencing but almost unknown in finance.

Foundation of our Adaptivv Sensor Technology

The BCP analysis provides an estimation of the current structural break point probability, trend and risk, which allows to detect changes in the underlying market dynamics much faster and more precisely than traditional (frequentist) approaches.

Bayesian Change Point Analysis

Using a mathematical model called Bayesian Change Point (BCP) analysis to measure regime changes is new to the financial market. This methodology is also used in other scientific fields like DNA sequencing but almost unknown in finance.

Applicable

to any Investment Universe.

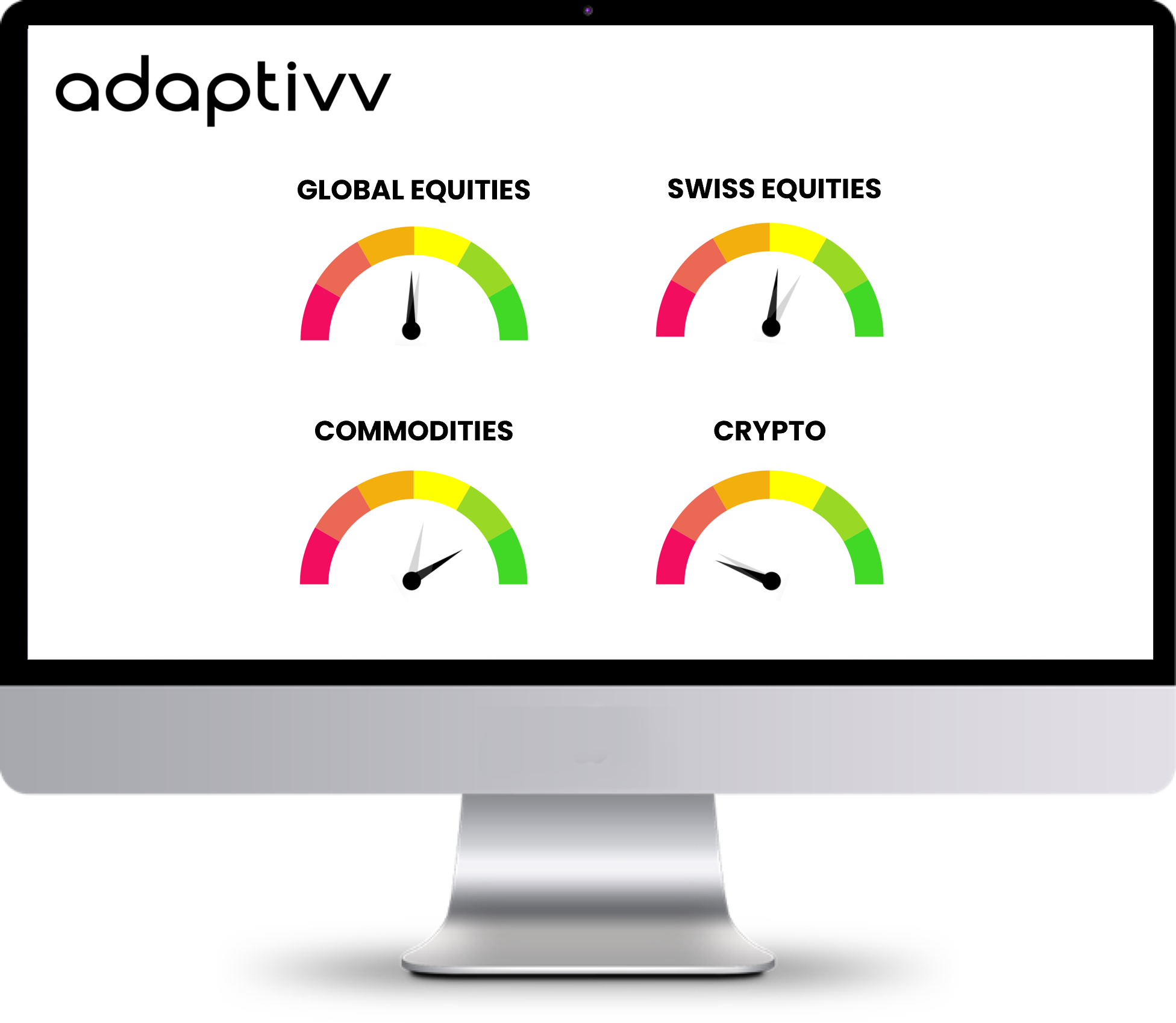

The Adaptivv Sensor Technology is applicable to any investment universe across all asset classes using the same methodology with no parameter fitting. Equities, Bonds, Commodities, FX, Crypto, we can help.

1. Universal Engine

Regardless of the asset class, the Adaptivv Sensor calibrates itself to the underlying market dynamics.

2. No Parameter Tuning

The Adaptivv Sensor can be universally applied to any market without changing parameters (no overfitting).

3. Faster Adaption

The Bayesian change point methodology ensures fast adaption to changing market dynamics in negative but also in positive (recovery) phases.

4. Scientific Proven

More than a decade of academic research at ETH Zurich, peer reviews across several disciplines and many scientific publications represent the foundation of our technology.

Felix Fernandez, Partner

„The Bayesian Change Point method is a robust and reliable approach to identifying regime changes in traditional as well as in digital markets.“

Our

Mission

Our mission during the development of our core technology at ETH Zurich was to find an answer to the question: “What is the best way to reduce drawdown and manage risk?”

After assessing many industry standards and technologies across scientific domains we learned that known approaches like Regression, Mean Reversion, Neural Networks, VaR/CVaR, Sentiment Analysis and Artificial Intelligence may work well in a historical simulation but then collapse in reality.

No Parameters

No Forecasts

The reason for this discrepancy is that all these approaches typically require many parameters, which lead to overfitting. In addition, the random nature of financial markets renders any attempt to forecast these properly worthless.

Based on this experience, we concluded that using “Nowcasts” (an accurate description of current market dynamics) in combination with periodic rebalancing is a much better approach to control drawdowns and manage risks.

Proof of Concept

Real World data (S&P 500 index) - These returns seem not to origin from a constant dynamic as the BCP probability peaks are clearly detectable.

Random walk (artificial index that has the same trend and variance as the S&P 500) - Here, the BCP detects that no structural break probabilities are present, which means that these returns originate from a constant dynamic, which is obviously true since those returns are generated by a random number generator.

The BCP method can reliably identify structural break probabilities, which can be shown when analyzing real and artificial data, where traditional methods would struggle to detect any changes..